Filing taxes can feel easier when you have your Kroger W-2 form ready. Whether you currently work at Kroger or former employee, this simple guide will help you understand how to access, download, or manage your W-2 form online or on paper.

How to Access Your Kroger W-2 Form as a Former Employee or After Quitting

Online Access:

- Visit MyTaxForm.com.

- Log in using your Kroger employee ID and PIN (the last four digits of your Social Security number).

- Find your W-2 form for the current tax year, then download or print it.

Paper Format:

- W-2 forms are mailed to your address on file by January 31st each year.

What to Do If You Haven’t Received Your W-2 Form?

- Contact Your Store Manager: Visit or call the nearest Kroger branch.

- Call Kroger Support: Dial 1-800-576-4377 for assistance.

- Reach Out to HR: Confirm your W-2 details and update your account information.

When Does Kroger Send Out W-2s?

Kroger mails W-2 forms to employees, including former employees, by January 31st. If you don’t receive it by mid-February, contact Kroger HR or access it online at MyTaxForm.com.

How to Check and Update Your W-2 Preferences

- Update your preferences before early January for electronic access.

- Log in to Kroger Express HR using your employee ID and password.

- Under settings, confirm if you have chosen paperless W-2 or paper delivery.

How to Download Kroger W2 Form Online for Employees

- Visit MyTaxForm.com.

- Log in W2 using your employee ID and PIN (the PIN is usually the last four digits of your Social Security number).

- Look for your W-2 form for the year you need.

- Click “Download” or “View Form” to save or print it for filing your taxes.

What to Do If Your W-2 is Incorrect

- Contact Kroger’s HR to report errors on your W-2 form.

- Request a corrected form, known as a W-2C, if approved.

Frequently Asked Questions

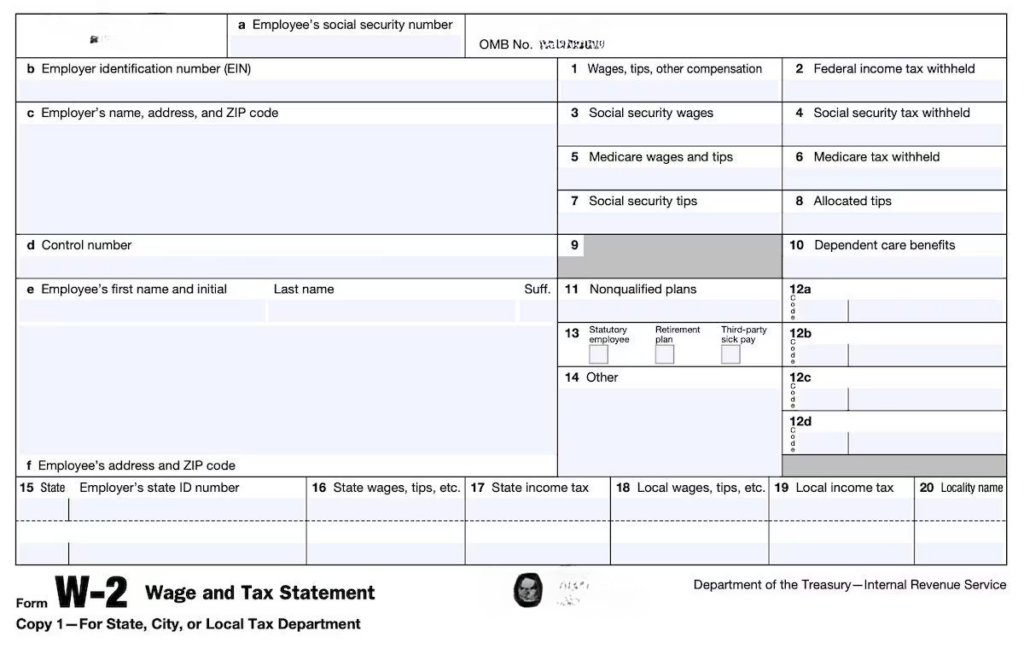

The W-2 form is actually a document for tax that will show your aggregate gross wages and taxes during the year. It is what an employer gives this form to an employee and also to the IRS, and it is required when filing your income tax return.

When a W-2 is lost or misplaced, there is no need to stress out, there are certain steps that must be followed for you to obtain the copy through the online means as follows:

-Open your browser, and go to the URL: MyTaxForm.com.

-Enter your employee ID and PIN number, commonly the final four digits of your SSN.

-Look for your W-2s for the specific tax year you are interested in printing or downloading.

In the event you are unable to access it online, contact Kroger’s HR or support team for assistance.

Should your W-2 form be sent to the wrong address:

-Contact Kroger HR to request reissuance and updating the address.

-Access digital copies via MyTaxForm.com.

-Consider getting USPS mail forwarding so future issues can be avoided.

-Access it online at MyTaxForm.com.

-Contact Kroger support at 1-800-576-4377 if you cannot access your form online

Yes, you can file your taxes without a W-2, but you’ll need to estimate your income and tax withholding or use your last pay stub for reference.

-Visit MyTaxForm.com.

-Log in with your former Kroger or Fred Meyer employee ID and PIN (default is the last four digits of your Social Security number).

-Find and download your W-2 form for the desired tax year.

-Use Kroger Express HR or MyLifeAtKroger.com if available.

-If you no longer have access, contact Kroger’s HR department or your store manager for assistance.

Reference:

Access Kroger W-2 and Payroll Guide : https://ess.kroger.com/myhrinfo/12MyPay.pdf